Those physicians with a large percentage of Medicare patients need to find ways to increase revenue and quality scores while improving the health of their patients. All too often with the Medicare patient, prevention takes a back seat to chronic illness and acute conditions. But an Annual Wellness Visit (AWV) creates an opportunity to make preventative care a priority for the patient while providing revenue for the doctor. It is also an opportunity to introduce Chronic Care Management Services for those who would benefit, which are now reimbursable under CPT Code 99490!

There is a recent study from the American Medical Group Association which shows that less than 20% of eligible Medicare patients received an AWV. It also notes that practices within an ACO are more likely to offer AWVs because they “…benefit financially from assessing health risks and filling care gaps.” Make no mistake, an AWV program requires time and money, but the physician group that is able to enlist eligible patients in an effective manner would most likely see a substantial return on investment. Why are AWVs not the status quo?

Some confusion often exists on the part of both patients and providers as to what exactly a “wellness visit” should entail. The scope of services to be provided should be well defined. Patient education about the process is also paramount. If issues arise from chronic illness or multiple conditions, or medication refills are needed, patients would schedule a future visit. This would be a good time to educate and enlist eligible Medicare patients in Chronic Care Management Services.

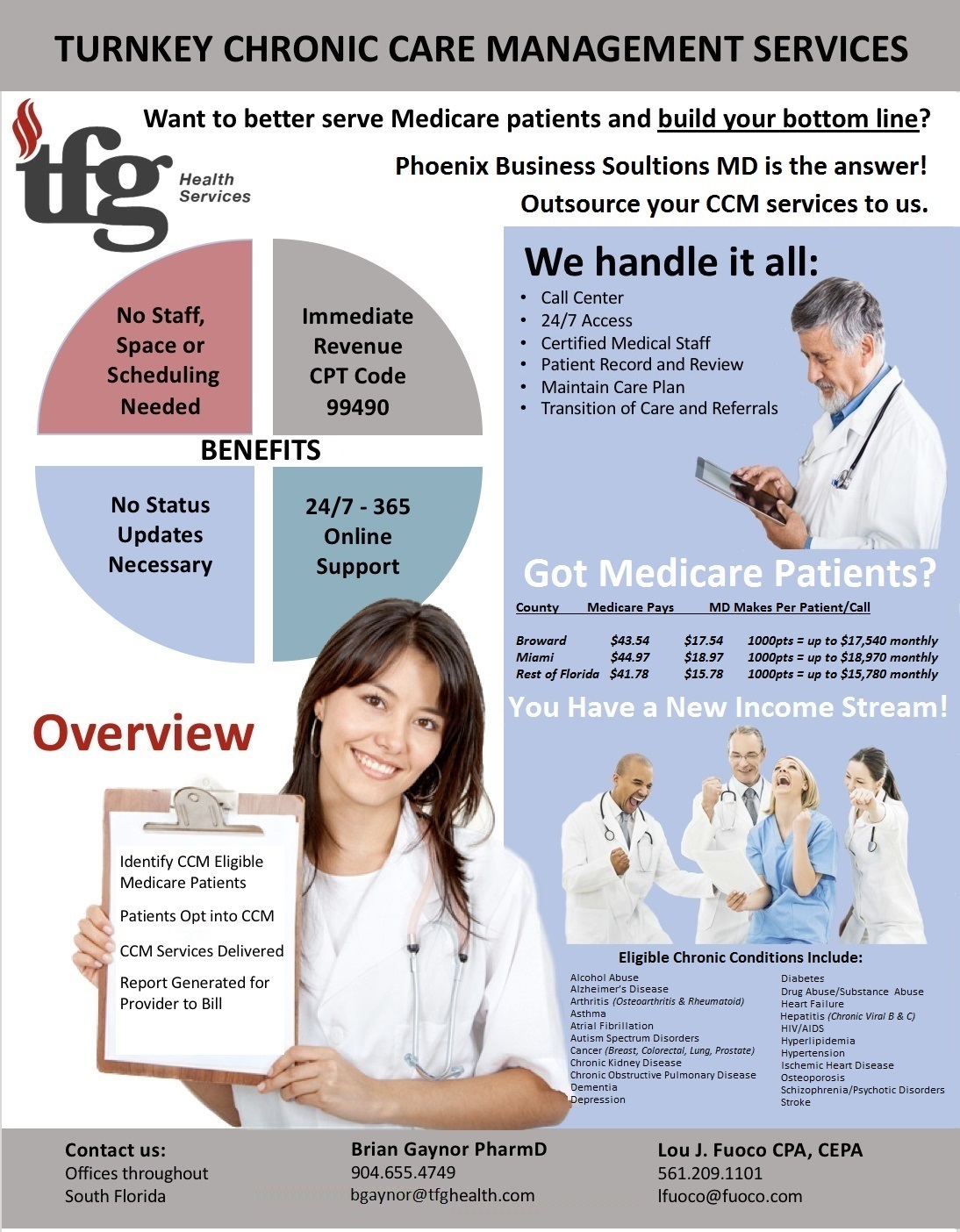

Operational challenges include: applying the appropriate process, proper coding, sufficient staffing, exam room availability, and the software/technology necessary for calendaring, notifications, scheduling, and email reminders. Protocols for data capture and retrieval must also be taken into account. An advantage is that turnkey solutions are available for administration of Chronic Care Management Services, which satisfy all CMS requirements for reimbursement.

Keep in mind, a well administered AWV program can generate follow-up visits for preventive services that patients might not otherwise inquire about. In addition, the screening tests and other preventive services arising from wellness visits can help raise quality scores.

Also on the positive side, as a preventative care visit the AWV does not always have to entail a physical exam by the provider, rather a highly structured screening and series of specific pre-determined questions can be administered by an RN or PA.

A best practice is to use EHR-interoperable software that is specifically designed to process the AWV smoothly and ensure compliance with all of the CMS requirements, including the automatic creation of an eligibility-based personal prevention plan.

Preventative care improves quality of life at a very reasonable price and AWVs can be used to even out income fluctuations during slow periods throughout the year. Some physicians find it financially beneficial to schedule the bulk of patient wellness visits in the slower Summer months because Winter flu season creates more sick visits. The added bonus is that the AWV is a perfect time to introduce CCMS and sign up eligible, interested patients.

Contact Us: There are many revenue drivers within the changing landscape of healthcare that TFG Health can help you identify. Make no mistake about it, wellness visits and Chronic Care Management Services drive dollars to doctors but also help patients to be healthier. Whatever your area of medical expertise might be, your professional accountants and healthcare advisors at TFG Health don’t want our doctors to miss any financial opportunities while they do what they love: practice medicine, and make life better for patients. Call Brian Gaynor at 904-655-4749, or Lou Fuoco at 561-209-1101, to see how your bottom line can get healthy!